The Fundamentals of product management are mostly constant: understanding users, aligning on business goals and strategy, prioritising effectively, collaborating across teams, and making data-informed decisions. What changes however, is the context in which those fundamentals are applied.

Nowhere is that more evident than in the fintech industry. Here, the rules are different: business models are shaped by transaction flows and credit risk, regulation is ever-present, and compliance is baked right into the product. Trust must be earned in every interaction, and even the smallest misstep can ripple into fraud, chargebacks, or regulatory scrutiny.

This is what makes fintech product management uniquely demanding but ultimately rewarding. The industry runs on its own norms, behaviours, regulatory guardrails, and definitions of success. I learnt this the hard way when I first transitioned into the fintech space over two years ago. The learning curve was steep, but it sharpened my product instincts, forced me to unlearn assumptions, and gave me a new lens for value.

This article is about helping you make that same leap but with clarity and understanding. In this writeup, we’ll explore:

How to evaluate if transitioning into the fintech industry is the right next step

Some Product skills that are transferable in the fintech industry

Practical Steps to guide your transition

Ready? Let’s go right in : )

But First, Why the Fintech Industry?

Before brushing up your CV or taking any steps, pause and ask the most important question: “ Why? “Switching into this industry should be a strategic move and like any good strategy, it needs a strong underlying “Why.”

Your answer doesn’t have to be profound, but it must be intentional. From my experience, I’ve seen many product managers make the leap into fintech for at least one of the following reasons:

Personal connection to the mission – Perhaps you’ve seen how hard it is for small businesses to access credit, you care deeply about building scalable financial infrastructure or improving financial access for underserved populations.

Desire for growth – Fintech moves fast, touches billions of lives, and forces PMs to operate at the intersection of tech, business, and regulation. If your current industry feels stagnant, fintech may seem like the next best thing.

Exploring new problem spaces – Maybe you’ve mastered SaaS or e-commerce and now want to see how your skills translate in domains with very different behaviours, risks, and regulations.

Burnout or misalignment – Sometimes, it’s not fintech pulling you in but your current industry pushing you out. Maybe the culture, pace, money, or values no longer fit, and you’re seeking work that feels more impactful or future-proof.

Whatever your reason, clarifying it serves two critical purposes:

Focus – Your “why” keeps you grounded and gives you a filter for evaluating opportunities as well as the conviction to stay the course when the transition feels hard.

Narrative – Your “why” shapes the story you tell others and yourself. In interviews, it proves you’re not making a casual experiment but a deliberate, intentional move. Hiring managers know fintech demands a steep learning curve; they’ll only take a chance on you if they believe you’re committed enough not to back out when it gets tough.

But here’s the harder truth: your “why” has to be strong enough to withstand pressure. If your motivation to move into fintech can be easily overturned by a slightly better salary in your current industry, a more supportive work environment, or simply taking some rest, then it’s worth questioning whether fintech is truly your next chapter or just an escape hatch. Transitioning is never easy so the decision must be anchored in something bigger than convenience.

But don’t stop at why. Once you’ve articulated your motivation, you need to evaluate whether this industry is truly the right next step for you.

How to Evaluate Whether the Switch is Worth It

Fintech has incredible opportunities; it’s fast-moving, well-funded, and shapes how people and businesses interact with money. But it also comes with steep demands: heavy regulation, slower iteration cycles, and the emotional weight of handling people’s financial lives.

Here’s how to see if the switch is right for you:

Connect to the Mission – Do you care about what fintech is trying to solve? Financial access, faster payments, wealth creation or reliable infrastructure? The best fintech PMs have a personal connection to the mission.

Assess Your Risk Appetite – Mistakes here can mean financial loss, regulatory fines, or broken trust. Do you thrive in high-stakes environments where precision matters as much as speed?

Consider the Learning Curve – You’ll need to pick up regulation, compliance, fraud prevention, and money movement basics quickly. If you enjoy learning new systems and translating complexity into simple product decisions, you’ll thrive here.

Map to Your Long-Term Goals – If you see yourself thriving in regulated industries or shaping how finance and tech intersect, fintech builds durable skills. If you prefer unregulated consumer tech, it may feel restrictive.

Talk to Insiders – Speak with PMs already in fintech. Ask what excites them, what drains them, and what they wish they had known before joining. Their answers will give you a reality check beyond job postings.

If your “why” is clear and the switch feels right for your long-term goals, the next step isn’t to update your CV or start applying. It’s to understand what you’re actually stepping into.

Understanding the Landscape

Now, here’s where a lot of people get it wrong: saying you want to “work in fintech” is super vague.

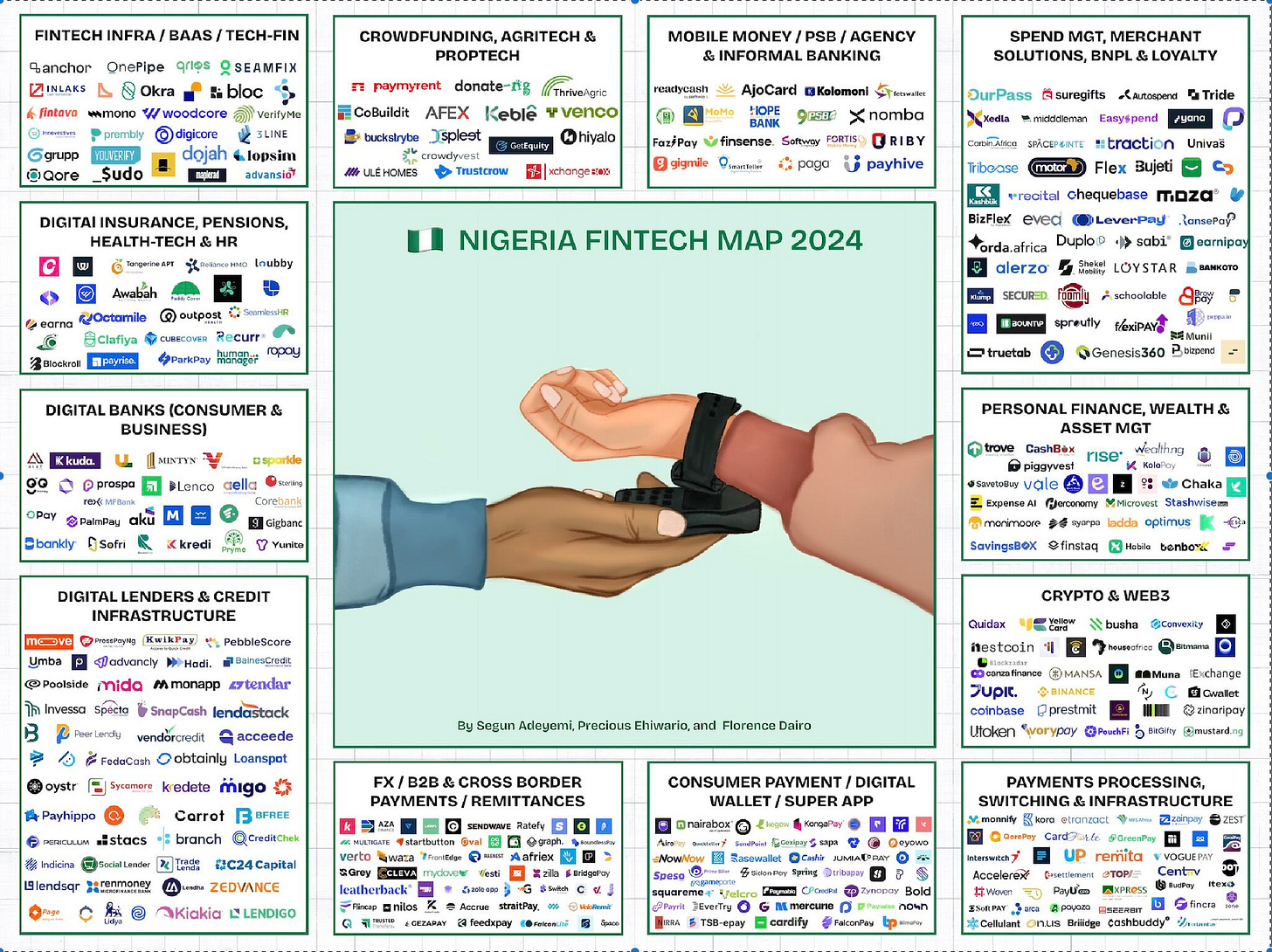

Fintech, short for financial technology, is the use of digital tools, platforms, and innovation to improve or reinvent financial services such as payments, lending, banking, insurance, investments, remittance etc. It isn’t a single industry but an umbrella of multiple sub-sectors, each with its own dynamics, challenges, and user needs.

Essentially, What makes the fintech industry different from building e-commerce, SaaS, or lifestyle apps is simple: money is at the centre. The stakes are higher, mistakes are costlier, and Regulations are a core product constraint.

Regulation, Terms, and Technologies Differ by Sector

Now that you know fintech isn’t one industry but a collection of sub-sectors, it’s important to understand something else: the rules of the game change depending on where you play.

The regulations, technologies, and even the terminology that apply in lending are very different from those in payments, wealthtech, or remittance. For example:

A Digital lender is governed by credit policies, data privacy laws, and debt recovery rules.

A Payments company must navigate payment & switching licenses, transaction settlement rules, and anti-fraud requirements.

A Wealthtech platform is shaped by securities regulation, investment disclosure laws, and custodial arrangements.

An Insurtech must comply with risk pooling frameworks, licensing requirements, and claims protocols.

And this list is not exhaustive. Each sub-sector has additional layers of oversight and operational nuance. Plus, the details can vary depending on the country, regulator, or even the specific product model.

Skills You Bring That Transfer Well (For PMs)

By now, it’s clear fintech is different; new regulations, new risks, and higher stakes. But here’s the good news: you’re not starting from zero. The skills you’ve already mastered as a product manager remain incredibly valuable. They become useful when applied in a money-sensitive, regulation-heavy environment.

Problem-Solving & Prioritisation: In fintech, problems rarely come neat and tidy. You’ll face failed transactions, compliance delays, fraud risk, or shifting regulations all at once. Your ability to break down complexity, weigh trade-offs, and prioritise what truly matters is one of your biggest assets.

Stakeholder Management: In other industries, your stakeholders might be limited to sales, design, and engineering. In fintech, more stakeholders such as compliance, risk, legal, regulators, banking partners and much more are added to that list. Success often hinges less on building fast and more on keeping these diverse voices aligned, informed, and engaged. Your stakeholder skills are what make impossible timelines and competing interests workable.

Building for Scale and Usability: A Downtime in SaaS is inconvenient; downtimes in fintech is catastrophic. Users expect payments to go through instantly, balances to always be accurate, loan repayments to never fail and nearly 100% uptimes. Your past experience designing scalable, user-friendly systems directly prepares you for fintech’s demand for both usability and system resilience.

Communication Across Business + Tech Teams: The ability to translate technical depth into business impact, and vice versa, is a universal PM strength, but in fintech, it’s amplified. You’ll need to explain to non-technical teams why settlement takes T+1 days instead of instantly, or help engineers understand the business implications of skipping a compliance review. Clear, confident communication becomes the glue that keeps the ecosystem working together.

Now that you understand how your core product skills translate into fintech, the next question is: how do you actually make the switch?

Knowing your strengths is only half the battle, the other half is closing the knowledge gaps and positioning yourself strategically.

Structured Steps to Guide your Transition

STEP 1 - Understand What You Don’t Know

As said earlier, fintech isn’t one single industry, it’s an umbrella of many different sectors that all operate by different rules, with unique technologies, regulations, and business models. That’s why the smartest way to begin your transition isn’t to try to “learn fintech.” It’s to pick one or two niches and focus your learning there.

Maybe you’re drawn to payments because you’ve always been fascinated by how money moves behind the scenes. Maybe lending resonates with you because you’ve seen firsthand how access to credit changes lives. Whatever your choice, narrowing down gives you focus, credibility, and a clearer story when you explain why you’re switching.

But here’s the challenge:

Once you’ve picked your niche, how do you figure out what you actually don’t know?

How do you avoid wasting time on noise, and instead target the knowledge that makes you effective in that space?

a. Use Job Descriptions as Your First Mirror

One of the fastest ways to uncover your gaps is to look at the expectations written into roles you want. Job descriptions represent a map of the skills and concepts that matter most in the industry.

Gather 20–40 job descriptions for PM roles in your chosen niche (e.g., “Payments Product Manager” or “Digital Lending PM”).

Highlight the skills, tools, and requirements that show up repeatedly across them.

Once you’ve spotted the patterns, run a gap analysis: note what you already know and where you’re lacking.

b. Talk to Practitioners for the Real Story

Job descriptions give you the “official” requirements, but speaking directly to people in the role reveals the day-to-day realities. These conversations surface the hidden details that JDs don’t capture.

Reach out to PMs or operators in your target niche through LinkedIn, fintech communities, or alumni networks.

Ask questions that reveal recurring concepts and pain points:

- “What terms or processes do you deal with every day?”

- “What do new PMs usually underestimate when they enter this space?”

- “Which regulations or workflows shape most of your product decisions?”

Compare answers across multiple conversations and you’ll quickly see themes.

STEP 2 – Learn the Fundamentals

Now that you’ve identified your gaps through job descriptions and practitioner conversations, the next step is closing them in a structured way.

The thing about fintech is that it’s a very broad space. There are regulators, risk officers, compliance experts, fraud analysts, and engineers who’ve spent years specialising in just one slice of the ecosystem.

As a PM, you don’t need to be a deep technical or legal expert, but you do need to know enough to collaborate with them, make informed decisions, and avoid costly mistakes.

That’s why self-learning matters, but relying on a single source isn’t enough. You’ll need to draw from different streams of knowledge such as courses, take trainings, YouTube channels, newsletters, podcasts, and hands-on product tear-downs to build a rounded view. Each one gives you a slightly different lens:

Courses and training programs provide structure and depth. (In Africa, platforms like Treford and Payments Vogue are excellent options for fintech and product-specific learning).

YouTube gives you visual walkthroughs of concepts like payment flows, KYC processes, settlement cycles etc.

Newsletters and reports help you stay on top of industry shifts and regulatory updates.

Once you’ve decided the sub sector(s) to focus, use a layered approach to avoid getting overwhelmed:

a. Use the 3-Layer Framework to Prioritise Your Learning

Instead of trying to absorb everything upfront, break your learning into three layers:

First-Order Knowledge (Must-Haves): These are the concepts you cannot afford to miss. Gaps here can lead to bad product decisions, regulatory violations, or user mistrust.

Second-Order Knowledge (Accelerators): These aren’t mission-critical on Day 1, but they help you collaborate faster, speak the language of your team, and unblock execution.

Third-Order Knowledge (Nice-to-Knows): These give you useful context, but they rarely affect your immediate impact. They’re things you layer on as you gain confidence.

b. Some Practical Ways to Learn Quickly (Without Burning Out)

Once you’ve mapped your priorities, here’s how to build momentum without overwhelming yourself:

Shadow from the outside - Join webinars, listen to fintech podcasts, or watch recorded compliance panels and product demos. Seeing real-world issues explained by practitioners is far more useful than just reading theory.

Interview practitioners - Reach out to PMs, compliance officers, or engineers on LinkedIn. Ask targeted questions like “What usually happens when a transaction fails?” or “Which parts of your process are most shaped by regulation?”

Deconstruct products in your niche -Immerse yourself in the fintech apps you want to work in. Sign up, use them end-to-end, and map out their user flows step by step. Look beyond the interface, analyse how transactions move, where risks are managed, and why certain design or compliance choices were made. Treat every app like a live case study, not just a product you use.

Build a personal glossary - Track every acronym or regulation you come across (e.g., PCI-DSS, ACH, KYC, AML, NIBSS) in your own mini-wiki. Here’s a FIntech Glossary you can check out.

Study the ecosystem - Read regulator circulars, fintech newsletters, and API documentation to understand the infrastructure behind the products.

What matters most isn’t knowing everything. It’s building learning velocity, the ability to synthesise information quickly, ask relevant questions, and form hypotheses you can test. The faster you build that muscle, the better.

STEP 3 – Build Domain Credibility

Learning on your own is important. But knowledge locked in your head doesn’t move the needle for hiring managers, stakeholders, or peers. In fintech especially, credibility is currency. It’s what convinces others you can be trusted to manage products in a high-stakes industry.

Credibility is built when people can see evidence of your understanding and as a transitioning PM, that means you need to make your learning visible and tangible.

Here’s how to do it:

Show your thinking publicly - Don’t just consume fintech content, share your own take. Write product tear-downs of apps you admire; reflect on regulatory changes, or publish short explainers of fintech terms. Teaching what you’ve learnt positions you as someone who is thinking critically, not just reading passively.

Build small, targeted projects - You don’t need to launch a full app to show value. Map out a sample loan lifecycle, diagram a payment transaction flow with risks annotated, or use no-code tools to prototype a micro-feature. These projects become proof points you can reference in interviews: “Here’s how I’d approach this flow.”

Engage with the ecosystem - Credibility also comes from being seen in the right places. Comment thoughtfully on fintech posts, join discussions in communities, share resources, and even collaborate on podcasts or newsletters. The more you contribute, the more the ecosystem recognises you as part of the conversation.

STEP 4 - Network

In this industry, what you know matters but who knows you matters just as much. Because the industry runs on regulation, partnerships, and trust. Opportunities circulate in networks long before they reach job boards. Here’s a few tips on what to do.

Choose the right spaces - Don’t try to be everywhere. Pick two or three fintech communities specialised groups, local ecosystems, or industry forums—where you can engage meaningfully. Consistency in the right spaces builds far more credibility than spreading yourself thin across dozens.

Contribute, don’t just consume - Share useful resources, answer questions, and summarise insights from webinars or panels. Even as a newcomer, adding value positions you as invested, not opportunistic.

Build intentional relationships - Reach out to PMs in your niche, ask specific questions (“What regulatory issue do you handle daily?” “If you had to explain this space in 10 minutes, what would you highlight?”), and offer something back even small contributions make relationships reciprocal.

Be visible at events - Attend demo days, fintech panels, or regulatory briefings, and engage actively ask thoughtful questions, follow up with speakers, and use chats to connect.

And above all, avoid spray-and-pray networking- Don’t cold-message 100 people asking for jobs. Be selective, patient, and authentic. Relationships in fintech compound over time, and the trust you build now becomes the credibility that accelerates your transition later.

Transitioning into the fintech space is one of the highest-leverage moves you can make as a product manager. It sharpens your fundamentals, challenges your assumptions, and pushes you outside your comfort zone in ways few other industries can’t.

I’ve made this switch myself, and I won’t sugarcoat it—some days are hard. Compliance jargon will feel foreign, you’ll question whether you’re learning fast enough, and imposter syndrome will creep in. But if you stay curious, commit to the craft, and show up consistently, you’ll find your rhythm faster than you expect.

You don’t need to be a fintech expert on day one, but you do need to be intentional: map your strengths, close your gaps, and build a culture of continuous learning. Once you do, you’ll not only thrive, you’ll carry the confidence and toolkit to adapt anywhere.

See you next week for another breakdown!

How do I like this write up multiple times? Thank you so much for sharing

I just read this and I must say, it was incredibly detailed and helpful.

I’m sure anyone feeling unsure about getting into fintech would walk away with much more clarity after reading this.

Big ups Seyifunmi