Market Sizing 101: A Guide for Product Managers

You might have a great product idea, a solid launch plan, and a clear vision. But if you don't know how big the opportunity truly is, you’re flying blind.

Market sizing plays a critical role in driving serious product and business decisions. Without it, building a product is like setting out on a journey without a map, it’s possible you’ll arrive somewhere, but highly unlikely it will be where you intended.

In this article, we'll be looking at why market sizing matters, the concepts of TAM, SAM, and SOM, different market sizing approaches, and a step-by-step guide to help you size your market confidently.

P.S - This article was inspired by insights from the Market Research course by Treford.

Ready? Let’s jump right in : )

But first, what is Market Sizing?

Essentially, market sizing is the process of estimating the potential demand for a product or service. It quantifies how many people might realistically want what you are offering, and how much revenue that demand could translate into.

While it’s a critical part of fundraising conversations, its impact stretches across product development, market entry strategies, pricing, and growth planning.

Here are four major reasons why getting Market Sizing right can make or break your product’s success.

1. Builds Investor Trust

No matter how compelling the vision, investors assess opportunities based on potential returns. A poorly defined or exaggerated market size signals risk. Alternatively, a clear, well-supported market sizing shows that you understand both the ambition and the constraints of the opportunity you are pursuing.

If you cannot explain the market you’re entering, how large it is, how accessible it is, and how much of it you can realistically serve, it becomes difficult for investors to believe in your strategic vision.

2. Informs Strategic Focus

Not every user or region is equally valuable. Not every adjacent market is worth pursuing. Understanding the structure and scale of your market enables better decisions about:

Prioritising segments (Which users to target first, and why.)

Roadmapping features (Which problems to solve based on addressable demand.)

Sequencing growth (Where and when to expand geographically or demographically.)

Market sizing helps you avoid spreading efforts thin across too many small bets.

3. Impacts Pricing and Revenue Planning

How you price a product should reflect not just the value it creates, but the purchasing power and scale of the intended market.

Without reliable market sizing:

Revenue projections become speculation.

Lifetime value calculations lose credibility.

Pricing experiments risk missing the mark completely.

A well-founded understanding of the market prevents mismatches between ambition and reality at critical stages of growth.

4. Improves Marketing and Go-to-Market Precision

Market sizing clarifies where the real opportunities are, and just as importantly, where they are not. Instead of relying on intuition or past experiences, teams can allocate marketing budgets, sales efforts, and partnership resources based on a clear understanding of reachable, valuable markets.

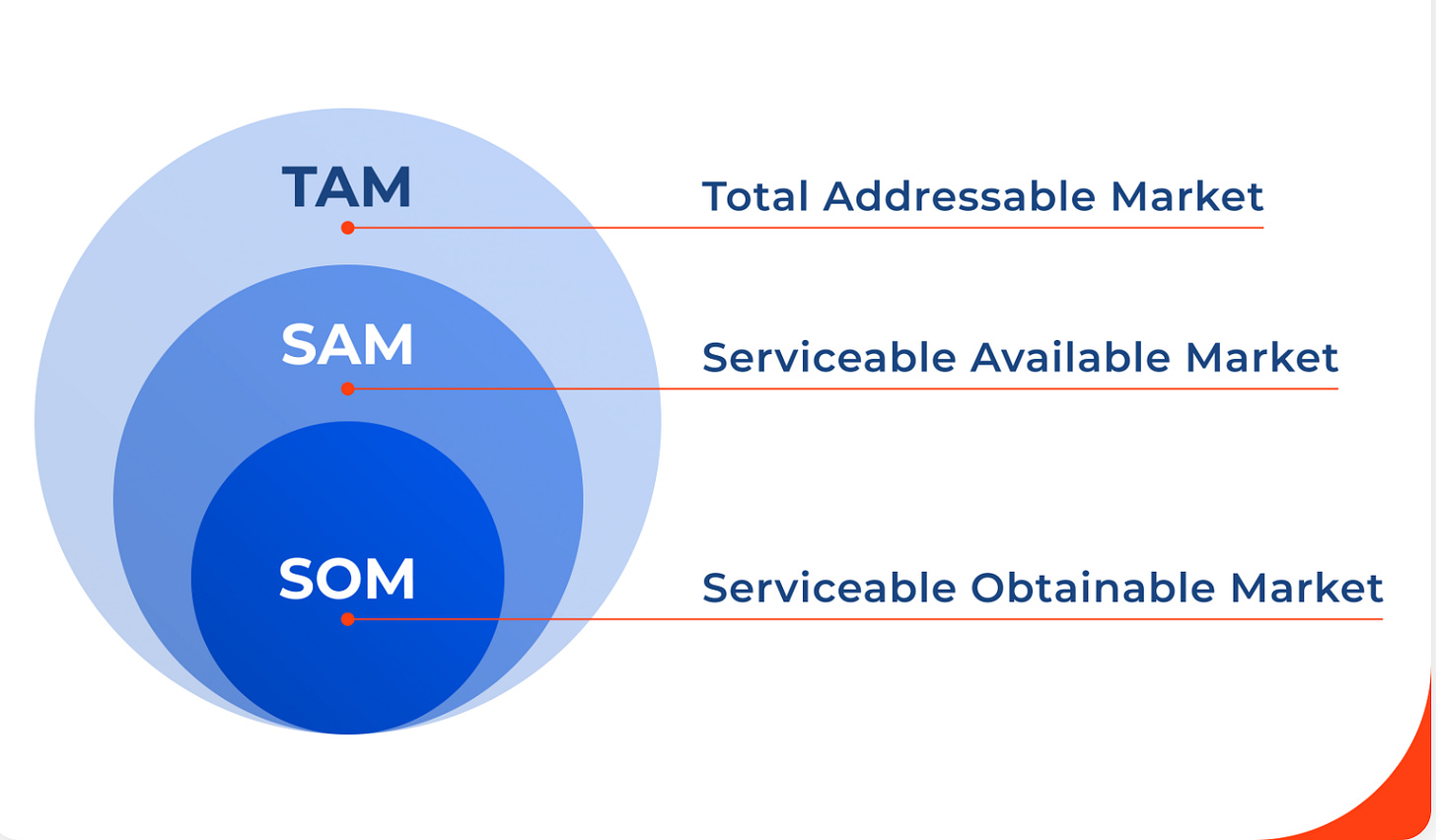

Before you can size your market properly, it’s essential to understand three core concepts that form the foundation of market sizing: TAM, SAM, and SOM.

Breaking Down TAM, SAM, and SOM

1. TAM – Total Addressable Market

TAM represents the total global demand for your product or service if every potential customer (everywhere ) could be reached, without any limitations. In other words, it is the absolute upper bound of your product's potential. It assumes:

Unlimited distribution

No competitive barriers

Full market awareness and adoption

For Example, If you are building a smartphone, your TAM would be the total number of smartphone users worldwide. If there are 6.5 billion smartphone users globally, then your TAM would reflect that total market.

Why TAM matters:

Understanding your TAM helps you define the true potential of the problem space you're addressing. It gives executives, investors, and internal teams a clear sense of the maximum opportunity and whether it’s worth the strategic investment.

2. SAM – Serviceable Available Market

SAM narrows the focus: it is the portion of the TAM that your product can realistically serve, given your current business model, geographic focus, and operational capabilities. It accounts for practical limitations such as:

Regional constraints

Platform preferences

Specific user needs or use cases

Example: Continuing the smartphone example, if you are specifically targeting Android users in Africa, then your SAM would be the number of Android smartphone users across the African continent. Not every smartphone user, just the segment your business is designed to reach with your current strategy.

Why SAM Matters:

SAM defines the opportunity available under your current model. It forces you to be honest about what part of the market you can serve today or in the near future, and filters out market segments that are either inaccessible or irrelevant to your offering ensuring your strategy is focused on reachable customers.

3. SOM – Serviceable Obtainable Market

SOM is the most realistic and actionable layer: it represents the portion of the SAM you can realistically capture in the short term, considering competition, resources, brand awareness, and go-to-market capabilities.

In simple terms: SOM is the share of the market you expect to win based on your specific strategy, team, and conditions.

As an Example, If your smartphone product is focused on Android users aged 18–30 in Lagos Nigeria who are early adopters, then your SOM is the estimated number of users fitting that demographic who you can expect to acquire within your launch window.

You are not targeting all Android users in Africa, only a specific subset, in a specific region, where your marketing, pricing, and distribution efforts are concentrated.

Why SOM Matters:

SOM provides a practical, short-term view of the real opportunity. It informs your initial business targets, sales forecasts, and go-to-market planning. It also forces discipline: instead of chasing a vast market, you focus on where you can truly win first.

Top-Down vs Bottom-Up Market Sizing

Once you understand the structure of your market — TAM, SAM, and SOM — the next question is how to actually estimate the numbers. There are two major approaches: Top-Down and Bottom-Up.

1. Top-Down Approach

The Top-Down approach starts with a large, general estimate( usually drawn from industry reports, analyst research, or public data) and narrows that figure down based on your target customer profile. It typically looks like this:

Start with a global or national industry figure (e.g., “The global health tech market is worth $500 billion.”)

Apply filters( geographic, demographic or behavioural) to adjust that figure to your target segment.

For Example:

Let’s say according to Statista, there are about 6.5 billion smartphone users worldwide.

To estimate your potential market, you’ll narrow that number step-by-step:

First, Africa accounts for roughly 12% of global smartphone users.

So 6,500,000,000 × 0.12 = 780,000,000 smartphone users in Africa

Next, you focus only on Android users.

Since 85% of smartphones in Africa are Android devices:

780,000,000 × 0.85 = 663,000,000 Android users

Then, you target a specific segment , urban users aged 18–30 , who make up about 30% of the Android market:

663,000,000 × 0.30= 198,900,000 target users

If you plan to monetise at $2 per user per month, the potential revenue looks like this:

Monthly revenue: 198,900,000 × 2 = 397,800,000 dollars per month

Annual revenue: 397,800,000 × 12 = 4,773,600,000 dollars per year

Using a top-down approach, you’ve estimated a target market of approximately 198.9 million users across Africa, with a potential annual revenue of around $4.77 billion — assuming you could capture 100% of that segment (which is rarely the case, so you would later adjust based on your realistic market share).

Strengths of Top-Down:

Fast to produce, especially in early-stage planning.

Useful for illustrating the big picture size of an industry.

Limitations of Top-Down:

High risk of being too optimistic or imprecise.

Depends heavily on assumptions about market relevance and accessibility.

Often viewed skeptically by investors if not paired with Bottom-Up validation.

Top-Down is best used as a framing tool, not as the sole basis for projections.

2. Bottom-Up Approach

Bottom-Up sizing builds your market estimate from concrete, specific data points often derived from actual user data, early pilots, surveys, conversion rates, and operational insights.

It typically looks like this:

First, look at how many potential customers you can directly reach (like contacts in your CRM, users in a pilot, or website visitors).

Next, add real behaviour data such as your conversion rates, churn rates, or how engaged users are.

Then, carefully project these numbers forward to estimate how much of the market you could realistically capture over time.

As an Example:

Let’s say you run a pilot program in Lagos targeting Android users aged 18–30. You reach a pool of 10,000 people and successfully convert 500 users, giving you a 5% conversion rate.

Now, based on public data, you find that there are about 2 million Android users in that age range across Lagos.

To estimate your obtainable market:

You apply your observed 5% conversion rate to the full potential audience:

2,000,000 × 0.05 = 100,000 users

This suggests you could realistically acquire around 100,000 users within your target group, if you scale efforts citywide under similar conditions.

If you plan to monetise at $5 per active user per month, your revenue projections would look like:

Monthly revenue: 100,000× 5 = 500,000 dollars per month

Annual revenue: 500,000 × 12 = 6,000,000 dollars per year

By using real pilot data, you’ve built a bottom-up market estimate showing a potential user base of 100,000 and projected annual revenue of $6 million — based on actual customer behaviour, not just assumptions

Strengths of Bottom-Up:

Based on observed behaviour, not assumptions.

Provides granular insight into acquisition costs, revenue per user, and retention metrics.

Stronger foundation for financial modelling and operational planning.

More credible to investors and internal stakeholders.

Limitations of Bottom-Up:

Requires real data or at least credible early tests, which might not be available for new markets.

Can be more time-consuming to collect and analyse.

Bottom-Up is preferred when you are making critical financial forecasts, building business cases for funding, or planning operational expansions.

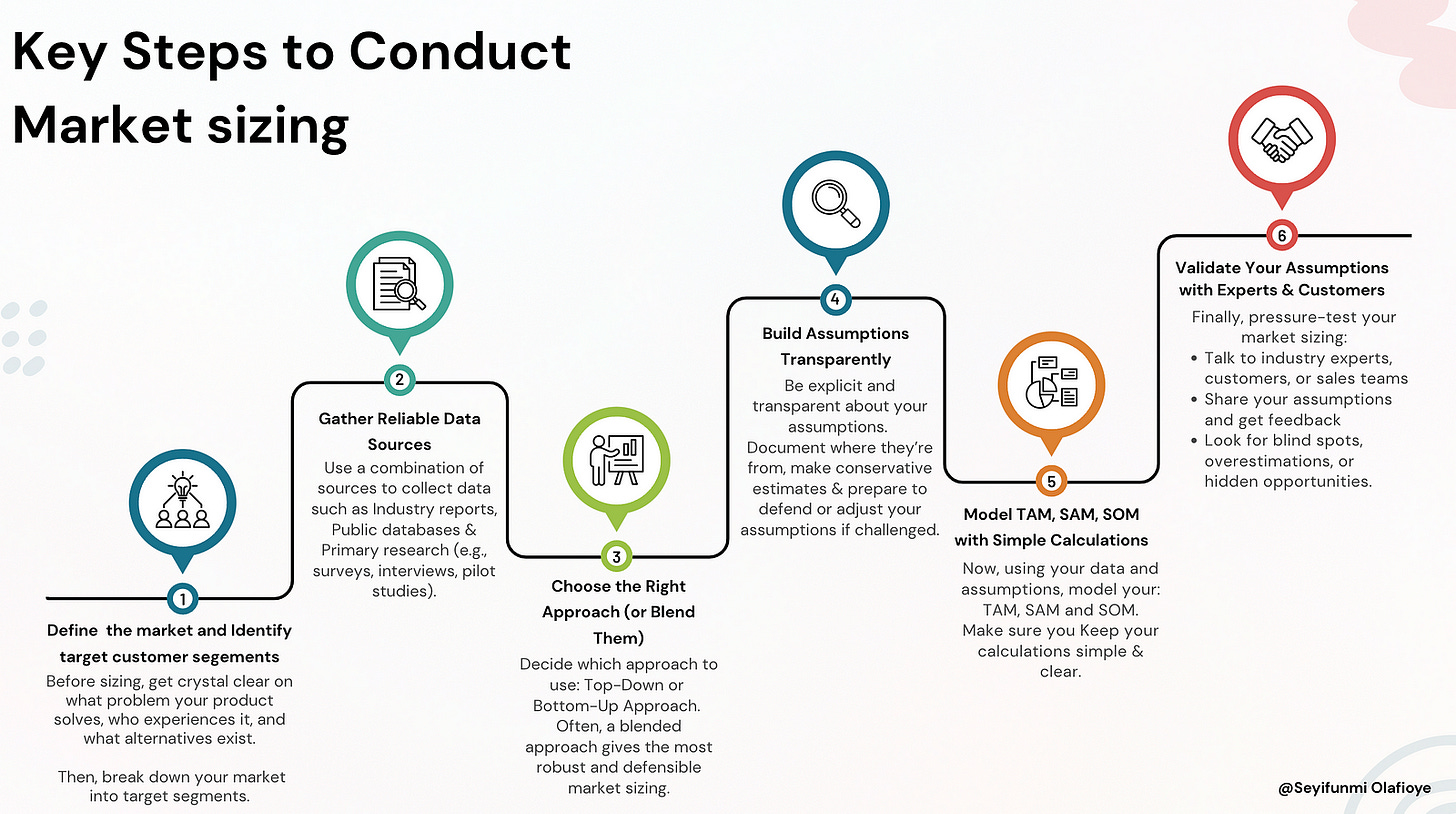

Conducting Market sizing

If you want to become a product manager who builds not just great products, but the right products, mastering market sizing is non-negotiable.

Remember, market sizing isn't a one-time exercise, it’s an evolving process. Start with simple, directional estimates and refine them as you collect more insights and customer data. Good market sizing evolves alongside your product and your understanding of the world it serves.

For more insights on how to use market research to build products customers truly love, check out the Market Research course that inspired this article.

Very helpful

This is a hard topic to simplify, I think you did a great job.