I remember the first time I came across the term “Open Banking.” It was sometime in 2022. I was scrolling through LinkedIn and came across a post from a popular industry leader passionately explaining how Open Banking was going to reshape financial services.

It made me curious, and several browser tabs later, I realised that while countries like the UK, Australia, and parts of Europe had already implemented Open Banking frameworks, Nigeria was still in the early stages. The conversations were happening, frameworks were being drafted, but it hadn’t yet been approved by the Central Bank of Nigeria(CBN). At that time, Open Banking felt more like a concept for the future than an immediate reality.

Fast forward to now, and that “future” is here. In April this year, the CBN officially approved the launch of Open Banking, setting the go-live date for August 2025. With this milestone, Nigeria will become the first African country to fully implement an Open Banking system, opening up new opportunities for fintechs, banks, and consumers alike.

But beyond the approval, what does this actually mean for those of us building products? In this article, we’ll take a look at:

What Open Banking actually is.

The Core Principles that drive Open Banking.

A High-level view of how Open Banking technology works.

Opportunities Open Banking Unlocks using some major industries as examples.

And of course, some of the risks and challenges product managers must navigate.

What is Open Banking?

First, Let’s start with some context.

For a long time, banks and other financial institutions have had a front-row seat to our financial activities tracking how we spend, save, and manage our money. Yet, despite having this data, the information has remained locked and mostly siloed within individual institutions.

If you bank with three different entities, none of them really see the full picture of your financial health. One bank might think you’re living recklessly, one might think you’re living pay check to pay check, while another sees you as a consistent saver. And often, that fragmented view works against you.

So, if you wanted a fintech app or lender to evaluate your financial health in order to access a financial service, you had to manually download bank statements and upload them yourself. To bridge this gap, data aggregators developed ways to help apps access your bank data with your consent. They built custom integrations with banks, and where banks didn’t offer official APIs, they used methods like secure logins and screen scraping to retrieve transaction history.

While these workarounds were mostly effective in making data accessible, they came with challenges. Integrations were fragile because banks could change their login flows, block access, or update their systems without notice, causing frequent data fetching issues for for parties that need access to this data. Meaning it was a patchwork solution that worked around the problem not through it.

This is exactly where Open Banking comes in.

Open Banking is (and essentially creates) a regulated system that allows customers to securely share their financial data, such as account balances, transactions, income details etc, with third-party providers through standardised APIs. With your explicit permission, this data can now flow between banks, fintechs, and other licensed financial institutions in real-time, through secure and official channels.

The key difference is how the data is accessed:

Before Open Banking: Aggregators had to rely on workarounds to fetch data.

With Open Banking: Banks are now required by regulation to provide secure, standardised API access, eliminating inconsistencies and improving reliability.

With Open Banking, the data will be shared through structured API frameworks that all banks and participating institutions can connect to, ensuring secure and consistent access across the ecosystem. A central registry will be used to identify and authenticate all participants (banks, fintechs, third-party providers), making sure that only verified entities can interact with customer data.

On top of that, a consent management framework tied to customers’ Bank Verification Numbers (BVNs) will ensure that you, the customer, remain in full control, deciding who can access your data, for what purpose, and for how long.

In real life, this means:

If you’re applying for a loan, you can give the lender permission to view not just your salary account, but also your savings and investment history across multiple banks. That broader view could improve your credit profile and fast-track your approval for credit.

Want better budgeting tools? Your finance app can now pull data from all your accounts, giving you a single dashboard that reflects your actual spending patterns in one place without messy statement uploads.

So, think of Open Banking as giving your trusted apps “read access” to your bank account(s), but through an official, secure, and regulated doorway.

It ultimately promotes financial inclusion and transparency, enables faster services, and opens the door for innovative products designed around the customer, not just the institution.

Core Principles of Open Banking

Open Banking isn’t a free-for-all where anyone can grab data, it’s a structured system built on clear principles that ensure data is shared securely, responsibly, and with full customer control. To understand how this ecosystem stays balanced, it's important to understand the core principles of Open Banking.

1. Customer Consent & Control

At the heart of Open Banking is customer consent. Nothing moves without the customer’s explicit permission. Unlike older systems where data sharing could happen behind the scenes, Open Banking ensures that customers are in full control of who accesses their data, what specific data is shared and for how long. Consent is not to be treated as a one time affair, it has to be transparent, revocable, and actively managed by the user. This tenet shifts power back to the customer, ensuring that data sharing is always a choice, not a default.

2. Data Portability & Access

With Open Banking, you can securely move your financial data across different platforms whenever you choose. This is known as data portability. It ensures that your financial information is not tied to one bank or service provider. Whether you’re using a new app to manage your savings, track expenses, or analyse your financial habits, your data can flow with you easily and securely.

For fintechs, this means they can no longer rely on locking customers in by keeping their data captive. Instead, they have to focus on building better, more useful services, because customers now have the freedom to take their data wherever they see more value.

3. Secure & Standardised APIs

One of the key innovations of Open Banking is the use of standardised APIs (Application Programming Interfaces). These APIs create a uniform way for banks, fintechs, and third-party providers to communicate securely and efficiently. Instead of custom integrations or inconsistent data formats, Open Banking APIs ensure that data is shared in a structured, predictable, and secure manner. This not only improves reliability and scalability but also makes it easier for new entrants to innovate without dealing with fragmented systems.

4. Regulatory Oversight & Compliance

Open Banking operates within a tightly regulated ecosystem. Bodies like the Central Bank of Nigeria (CBN) define the rules of engagement, monitor participants, and enforce compliance. This tenet ensures that the ecosystem maintains trust and stability, protecting consumers while enabling innovation. For product managers, understanding the regulatory obligations (such as audit logs, data access controls, and consent documentation) becomes essential when designing Open Banking-enabled products.

How Open Banking Technology Works

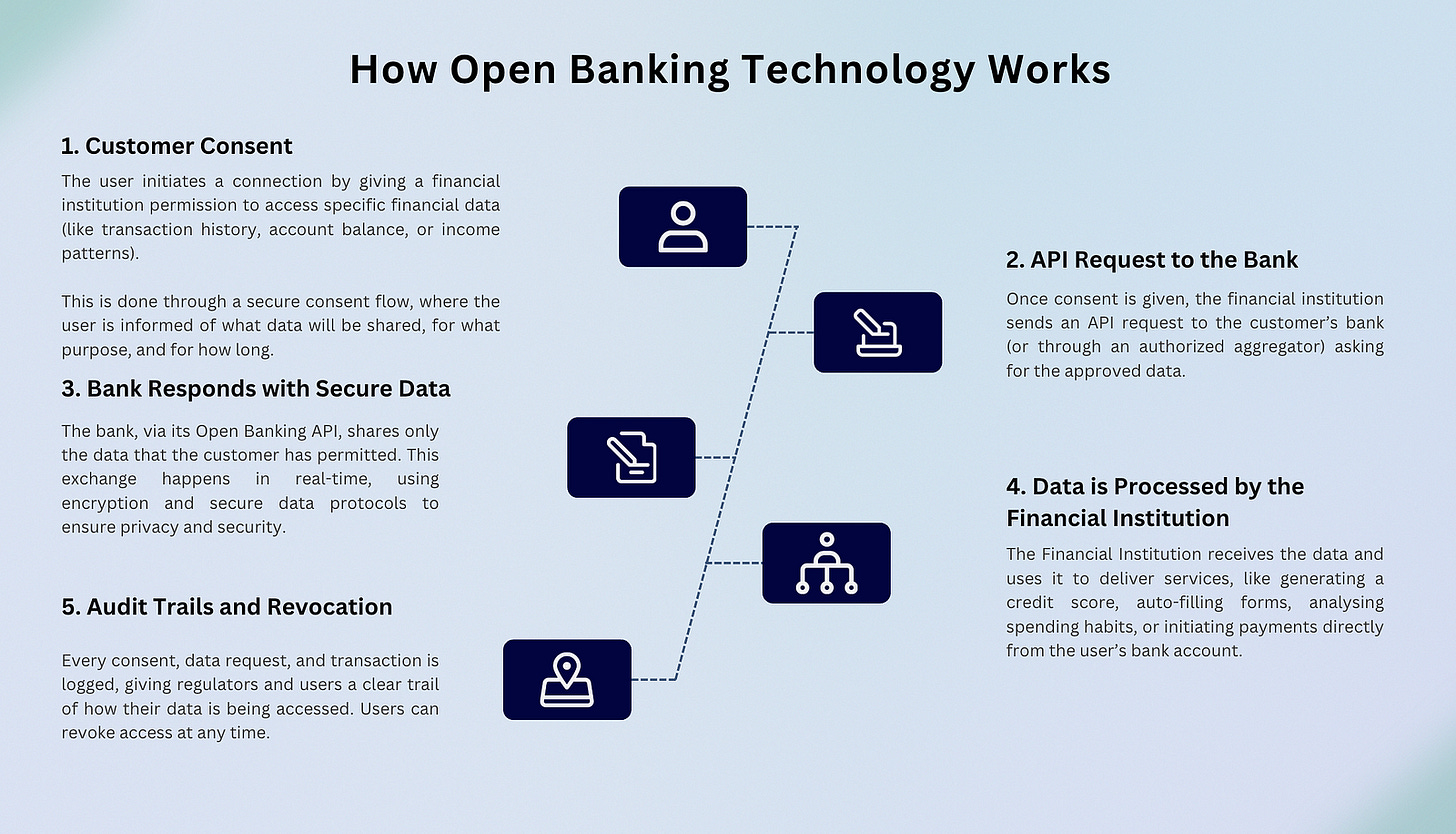

Here’s a simplified high level flow of how it works:

Opportunities Open Banking Unlocks Across Major Fintech Verticals

1. Payments: Cheaper, Faster Account-to-Account Transfers

Today, most digital payments in Nigeria run through the NIBSS Instant Payment (NIP) network or card processors. These come with operational costs, dependencies, and sometimes reliability issues.

With Open Banking, account-to-account (A2A) payments can bypass traditional rails, allowing fintechs to initiate direct transfers through bank APIs—with the customer’s consent. This creates opportunities for:

Cheaper wallet top-ups (no card fees)

One-click bank-to-bank payments

Seamless recurring payments (subscriptions, utilities)

Embedded payments for e-commerce platforms

2. Lending: Smarter, Instant Credit Decisions

Access to real-time bank transaction data changes the game for digital lenders. Instead of relying on outdated credit bureau scores or statement uploads, lenders can assess a customer’s financial behaviour on-demand.

Opportunities include:

Instant creditworthiness checks based on verified cash flows

Pre-approved loans for users with consistent income patterns

Dynamic credit limits that adjust based on real-time account activity

Extending credit to thin-file customers (informal workers, gig economy) using alternative financial data points

This reduces fraud risk, speeds up loan approvals, and expands access to credit for previously underserved segments.

3. Wealth Management: Holistic Financial Visibility

Most Nigerians have multiple bank accounts, wallets, and savings apps, but no single view of their complete financial life. Open Banking enables cross-bank account aggregation, giving wealth tech platforms a 360° view of user finances.

This opens up opportunities for:

Automated financial planning tools that track spending, income, and investments across platforms

Smart savings recommendations based on real-time cash flow patterns

Personalised investment suggestions tied to actual financial behaviour (not just self-reported risk profiles)

Building a “financial dashboard” that demystifies money management for mass-market users

Wealth management becomes proactive, personalised, and accessible to the everyday Nigerian, not just high-net-worth individuals.

Risks and Challenges Product Managers Must Navigate in Open Banking

While Open Banking creates exciting opportunities for innovation, it also introduces a set of risks and challenges that product managers cannot afford to ignore. With great access to data comes the responsibility of managing security, compliance, and trust especially in a market like Nigeria, where regulatory oversight is evolving and consumer trust in data handling is fragile.

Here are the key risks and challenges to keep in mind:

1. Data Privacy and Security Risks

When you build products that access sensitive financial data, the risk of data breaches, leaks, and unauthorised access increases. Even if you’re pulling data through regulated APIs, you need to ensure:

Data is encrypted both in transit and at rest.

Access is limited to only what’s necessary (data minimisation).

Third-party service providers (like aggregators) also comply with top-tier security standards.

Your systems have strong identity verification and secure authentication (multi-factor auth, tokens).

For product managers, this means working closely with your engineering and security teams to bake security into product design not add it as an afterthought.

2. Consent Management Complexity

One of the core principles of Open Banking is user consent, but managing that consent in a way that’s transparent, auditable, and user-friendly is a major challenge.

How do you design consent flows that are clear and not overwhelming?

How do users easily see and manage what data they’ve shared, with whom, and for how long?

What happens if a user revokes access, does your system respond immediately and stop using their data?

For product managers, this means building consent as a living, user-controlled feature not a one-time checkbox. It requires thoughtful design, real-time system responsiveness, and clear visibility for users to manage their data access at any moment.

3. Compliance, Operational Liabilities, and Staying Audit-Ready

While Nigeria’s CBN Operational Guidelines for Open Banking laid the foundation, compliance is far from static. As Open Banking adoption grows, regulations will continue to evolve, addressing new data handling practices, emerging security risks, and scenarios regulators may not have anticipated. Product teams must stay actively aligned with these shifts, keeping up with updates from the appropriate regulatory authorities.

But compliance isn’t just about staying updated on paper. With access to sensitive financial data, your product becomes part of a regulated data supply chain. Any misuse, breach, or oversight, whether from your own platform or a third-party partner exposes you to significant legal and operational risks. These include regulatory fines, license revocations, reputational damage, and user attrition.

Ensuring compliance means:

Building products that are audit-ready by design, with clear data access logs and processing trails.

Embedding flexibility in your systems to adapt swiftly as regulations change.

Establishing strong internal controls, vendor management processes, and accountability frameworks across your product organisation.

Collaborating continuously with legal, compliance, and data governance teams, not just during rollouts but as part of day-to-day product operations.

4. Interoperability and API Reliability

While Open Banking aims to standardise APIs, the reality of inconsistent API implementations across banks is a challenge. Banks might interpret standards differently, causing:

Inconsistent data formats

API downtime and latency issues

Poor user experiences if data fetching fails or lags

Product teams need to:

Build robust fallback mechanisms.

Partner with reliable API aggregators or build direct bank integrations with solid SLAs.

Design flows that gracefully handle data fetching errors.

5. Managing Consumer Trust and Skepticism

In markets like Nigeria, data sharing is still viewed with suspicion. Many users are wary of linking their bank accounts to third-party apps, fearing fraud or unauthorised debits.

You must design trust-building experiences, with clear language, no fine-print tricks, and visible assurances of security.

Education is critical: explain why you need data, how it will be used, and what control the user has.

Dark patterns or over-aggressive data prompts will backfire and erode trust.

Open Banking in Nigeria is now becoming a reality. For product managers, this is a clear opportunity to move beyond fragmented data and outdated workarounds, and start building financial services that are smarter, faster, and more user-focused. With standardised APIs and consent-driven data access, teams can design products that truly reflect the financial lives of their customers. At the same time, it raises the bar for how we approach security, compliance, and customer control in every product decision. The ecosystem is ready, now it’s on us to build responsibly and at scale.

I hope this article has given you a clearer understanding of what Open Banking means for product teams and what it takes to build in this new ecosystem.

Until next week